Free Toolkit for SME Business Buyers

Buy Your First

(or Next) Business with Clarity and Confidence

A practical toolkit for individual acquirers and dealmakers.

Tools to help you source, assess, structure, and close a business acquisition — smarter, faster, and with fewer missteps.

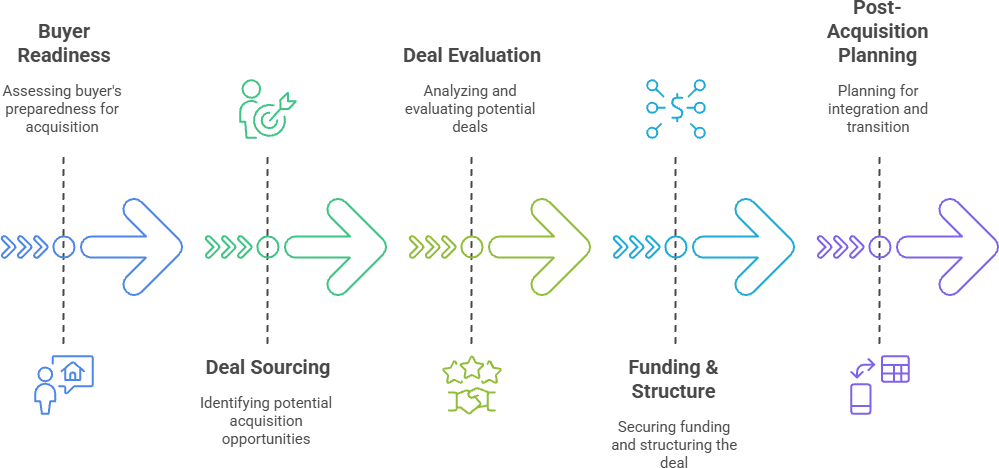

The SME Acquisition Journey

Understand the full process before you start — and see which stage you’re in.

From your first checklist to post-deal planning, this map shows how the toolkit guides you every step of the way.

Think Like a Buyer

Get clear on your goals, criteria, and funding capacity

Avoid common mistakes and “shiny object” deals

Tools to build your confidence and readiness

Source & Analyse Deals

Templates to track and qualify opportunities

Step-by-step guides for outreach and evaluation

Includes our flagship Deal Analyser tool

Structure & Close With Clarity

Understand funding options and deal structures

Know what to ask sellers and what red flags to watch

Plan your first 90 days post-acquisition

STEP 1: SELF-ASSESSMENT

Not Sure Where to Start?

Take the quick 2-minute quiz to find out how ready you are to buy a business — and what to focus on first.

Get instant clarity on your next steps — no jargon, no fluff.

Step-by-Step Acquisition Support

Tools That Match the Way Deals Actually Happen

From building your buyer profile to structuring and funding your deal — each tool aligns with a real stage in the SME acquisition journey. No theory, just real-world, usable support at every turn.

Built for Independent Buyers

Made for Solo Buyers, First-Timers, and Micro-PE

You don’t need to be a fund to buy a business — but you do need the right tools. This toolkit gives you clarity, confidence, and leverage in every conversation — from sellers to brokers to funders.

Built by Someone Who’s Been in the Buyer’s Seat

Because Buying a Business Shouldn’t Feel Like Guesswork

Most buyer resources are generic, outdated, or focused on large corporate deals.

This toolkit is different — it’s built from years of hands-on acquisition work with real UK SMEs.

It’s for individual buyers, searchers, and micro-funds who want to buy smarter — without wasting time, chasing bad deals, or second-guessing every decision.Whether you’re just getting started or already reviewing deals, these tools are here to make your next move sharper and more structured.

Less noise. More clarity. Designed for real-world buyers.

Built by Someone Who’s Been in the Buyer’s Seat

Let’s Talk About Your Next Move

Whether you’re reviewing your first opportunity, structuring a deal, or simply not sure what’s next — feel free to reach out.No pressure, no pitch — just helpful insight from someone who understands the buyer’s journey.

Prefer to just explore? That’s fine too — head back to the tools whenever you're ready.

What You'll Work Through, Step by Step

Each Tool Matches a Real Stage of the Deal Journey

This toolkit is split into five focused sections. Whether you’re just starting out or already reviewing deals, you can jump in at any stage.

No fluff — just practical tools to help you move forward with confidence and clarity.

Less noise. More clarity. Designed for real-world buyers.

Section 1: Buyer Readiness

Clarify your goals, strategy, and financial capacity before chasing deals.

Define your target — and avoid wasted time.

Section 2: Deal Sourcing

Track, filter, and generate deal flow — whether direct-to-seller or via brokers.

Build credibility and qualify leads early.

Section 3: Deal Evaluation

Evaluate deals fast and thoroughly.

Use our Deal Analyser to separate good opportunities from distractions.

Section 4: Funding & Structure

Understand how deals are actually financed and structured.

Get funding-ready and model realistic outcomes.

Section 5: Post-Acquisition Planning

The deal isn’t the finish line.

Use our tools to transition, integrate, and hit the ground running.

.

Sector-Specific Tips

Sector-Specific: Manufacturing

Check these before moving forward:

Check these before moving forward:

Machinery condition and replacement timelines

Production capacity vs. actual utilisation

Supply chain dependency and stability

Hidden maintenance or CAPEX traps

Key labour skill risks and retention issues

Sector-Specific: Services

If you're buying a services business, consider:

Owner reliance in client relationships

Retainer vs. project contract types

Staff qualifications or regulated licences (e.g. Gas Safe, FCA)

Client churn rates and satisfaction indicators

Operational efficiency gaps

Sector-Specific: Wholesale / Distribution

Look out for:

Inventory turnover and ageing stock

Delivery logistics and route efficiency

Gross margin stability

ERP or stock systems in use

Customer concentration risks

.

Sector-Specific: Retail

Before you buy, make sure to check:

Lease terms and local footfall trends

Seasonal revenue variation

Impact of online competition

Staff churn and wage burden

Fit-out quality and brand perception

Start with Strategy — Not Just Listings

Get Clear on What You Want, Why You Want It, and What You Can Afford

Before jumping into deals, get clarity on your personal goals, acquisition criteria, and funding capacity. These tools help you avoid chasing the wrong opportunity — and build confidence that you're ready for the right one.

Need a quick reference?

Download the one-page checklist for this stage to stay focused and organised.

Acquisition Readiness Checklist

Assess whether you’re really ready to pursue a deal

Covers mindset, finances, time, and personal alignment

Great first tool to get started

Buyer Criteria Builder

Define your ideal target business

Set filters for size, sector, location, team, and complexity

Helps avoid distraction and wasted energy

Personal Funding Planner

Identify what capital you can bring to a deal

Understand how far your funds can stretch

Helps shape realistic expectations around deal size and structure

James – First-Time Buyer, Manufacturing Sector

"James was overwhelmed with options and unsure what business suited him. After using the Buyer Readiness tools, he clarified his criteria: B2B manufacturing, £500K+ profit, Central Scotland. This focus saved him months of wasted search time."

Avoid These Mistakes in Buyer Readiness

Don’t skip defining your financial boundaries early

Avoid chasing every opportunity — get specific on fit

Don’t ignore personal post-deal goals

Overestimating capacity (“I can fix anything”) is risky

Not having a plan = wasted months

What’s Next?

Now that you've clarified your acquisition criteria, it’s time to start finding live opportunities.

→ Head to the Deal Sourcing section to begin your search strategy and track active leads.

Stop Waiting — Start Finding

Build a Deal Flow That Works for You (Not Just Brokers)

Good opportunities rarely land in your inbox. These tools help you take control of your deal search — track leads, build broker credibility, and start direct-to-owner conversations with confidence.

Need a quick reference?

Download the one-page checklist for this stage to stay focused and organised.

Deal Tracker Template

Organise inbound and outbound deal flow in one place

Track stage, seller notes, and next actions

Simple format you can update weekly

Outreach Template Pack

Email templates for brokers and sellers

Includes intro messages, follow-up nudges, and credibility positioning

Saves hours of writing — and builds trust faster

Seller Call Prep Guide

A one-pager to help you prep for first conversations

What to ask, what not to say, and how to leave a strong impression

Great for building rapport and spotting red flags early

Sarah – Part-Time Searcher, Services Sector

"Sarah worked full-time and had limited hours to search. By using the Deal Sourcing checklist and outreach templates, she built a simple tracker and connected with 5 serious brokers in 2 weeks. One later brought her a deal that fit perfectly."

Avoid These Mistakes in Deal Sourcing

Only using public marketplaces = limited options

Not tracking deals = wasted time and duplicate effort

Poor buyer intro emails = no responses

Failing to follow up = missed opportunities

Chasing too many sectors = dilution of focus

What’s Next?

You’ve set up your search — now start evaluating deals with confidence.

→ Go to the Deal Evaluation section to screen opportunities and assess financials.

Not All Deals Deserve Your Time

Evaluate Opportunities with Clarity — and Walk Away When It’s Right

Most buyers waste months chasing bad deals. These tools help you quickly evaluate what’s worth pursuing — and what’s not — using structured thinking and consistent decision-making.

Need a quick reference?

Download the one-page checklist for this stage to stay focused and organised.

Deal Analyser

Score potential acquisitions across 10+ critical factors

Flags deal risk, funding gaps, and buyer-seller misalignment

A fast, objective tool to sanity-check opportunities early

Red Flag Checklist

Identify warning signs that often get overlooked

Covers financials, operational risks, and seller behaviour

A simple gut-check before you commit time or money

Quick Valuation Tool

Enter real financials and get an instant valuation estimate

Uses sector benchmarks and normalisation logic behind the scenes

Perfect for screening deals and sense-checking seller expectations

(Powered by ValuBiz)

Tom – Experienced Operator, First Acquisition

"Tom had run businesses before but never acquired one. The Deal Analyser tool helped him quickly screen 6 targets. One stood out. He used the Deal Evaluation checklist to validate numbers and spot red flags early — and walked away from a risky deal."

Avoid These Mistakes in Deal Evaluation

Trusting the broker’s numbers without verification

Ignoring normalisation adjustments (salary, rent, etc.)

Underestimating working capital needs

Skipping customer/dependence analysis

Overlooking hidden risks in EBITDA

What’s Next?

Ready to make a move? Time to understand how to fund and structure the deal.

→ Explore the Funding & Structure section to build a viable offer.

Smart Buyers Don’t Always Pay in Cash

Learn How Deals Get Funded — and Structured to Work

This section helps you understand what funders look for, how deal structures work, and how to realistically finance a business acquisition — even if you don’t have deep pockets.

Need a quick reference?

Download the one-page checklist for this stage to stay focused and organised.

How Buyers Fund Deals

Simple explainer on funding sources: debt, seller finance, earn-outs, etc.

Understand what’s common, what’s creative, and what’s possible

Clarifies how much you actually need upfront

Deal Structure Worksheet

Map out how a deal could be structured (cash, loan, vendor terms)

Adjust different inputs to see what’s workable

Helps you prepare for negotiations and lender discussions

Bank Pitch Checklist

What to prepare before speaking to a lender or broker

Ensures you come across as credible, organised, and fundable

Saves time and embarrassment during funding conversations

Aisha – Solo Buyer, Retail Business

"Aisha had limited capital but a strong operator background. Using the Deal Structure Worksheet, she modelled a deferred purchase with a 50% seller loan. The Bank Pitch Checklist helped her secure the rest through asset-backed finance — deal done."

Avoid These Mistakes in Funding & Structure

Assuming banks will lend without prep

Relying only on cash upfront

Not modelling deferred payment cashflows

Ignoring seller psychology when proposing terms

Not preparing a simple funding pitch deck

What’s Next?

You’ve got a structure — now make sure you’re ready for what comes after the deal.

→ Visit Post-Acquisition Planning to prepare your transition and first 90 days.

The Deal Isn’t the Finish Line — It’s the Starting Line

Buy the Business. Then Make It Yours.

Too many buyers close a deal… then scramble. These tools help you hit the ground running post-acquisition — with clarity, structure, and confidence from day one.

Need a quick reference?

Download the one-page checklist for this stage to stay focused and organised.

90-Day Integration Plan

Your first 3 months mapped out in simple steps

Focus areas: people, cash, systems, and stability

Helps avoid chaos and earn trust quickly

Owner Transition Guide

How to work with the seller post-sale

What to ask, how to manage handover, and when to draw the line

Designed to smooth the relationship and minimise disruption

New Buyer Checklist

A practical pre-completion and post-deal checklist

Covers everything from company accounts to customer announcements

Keeps you organised when things get hectic

Mark – Acquired a Logistics Firm

"Mark closed a deal but underestimated the integration risk. He used the Post-Acquisition checklist to reset: retained key staff, communicated with major clients, and prioritised tech fixes. Six months later, performance was up 15%."

Avoid These Mistakes in Post-Acquisition Planning

No 90-day plan = chaos

Poor staff communication = turnover risk

Delaying system fixes = compounding issues

Ignoring key customer retention

Assuming growth will be instant post-deal

Need More Help?

If you're preparing for a live deal or want expert support through the final stages…

ValuBiz - how it works

Get a quick estimate of your business value

Estimate the Enterprise Value of your business in under 5 minutes using the tool below.

No personal details required.

Instant Results.

Takes a few minutes of your time.

1.

Provide a few details.

Input your last 3 year average EBITDA

Select your MAIN Sector from the dropdown

Select your SUB Sector from the dropdown

2.

Get an estimated valuation range.

You will see two values:

EBITDA Multiple (x): the multiple for your business

Enterprise Value (£) the value for your business

3.

Contact us for an in-depth valuation.

Get in touch for a detailed valuation which will take a close look at your accounts, from the P&L and Balance Sheet and any adjustments / normalisation.

Thanks for exploring the toolkit

You're now better equipped to buy a business

Whether you're at the start of your journey or actively reviewing deals, the Acquisition Toolkit gives you the structure and confidence to move forward.

Keep using the tools, build your pipeline, and take bold, smart action.